Worksheet Approach

Occasionally, one may desire to prepare financial statements that take into account

necessary adjustments, but without actually updating journals and

ledgers. Why? A manager may desire monthly financial reports even though

the business may not formally prepare and book adjusting entries every

month. A worksheet approach can be used for this purpose. Or, an auditor

may use a worksheet to prepare financial statements that take into

account recommended adjustments, before proposing that the actual

journal/ledger be updated.

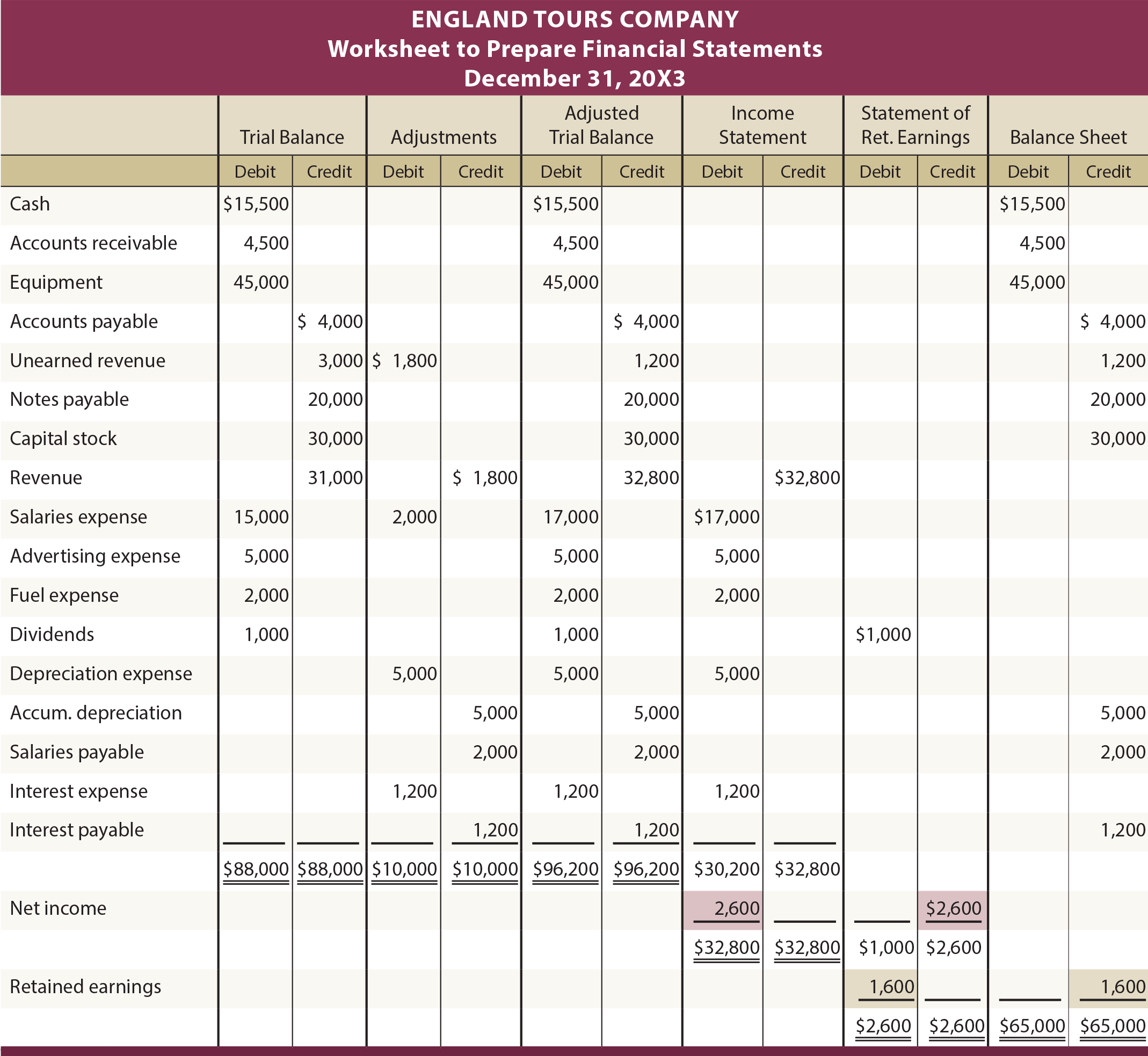

The following illustrates a typical

worksheet. The data and adjustments correspond to information previously

presented for England. The first set of columns is the unadjusted trial

balance. The next set of columns reveal the end-of-period adjustments.

The information in the first two sets of columns is combined to generate

the adjusted trial balance columns. The last three pairs of columns are

the appropriate financial statement extensions of amounts from the

adjusted trial balance columns.

For example, Cash is an asset account with a debit balance, and is “appropriately” extended from the adjusted trial balance columns to the debit column of the balance sheet pair of columns. Likewise, Revenue is an income statement account with a credit balance; notice that it is extended to the income statement credit column. This extension of accounts

should occur for every item in the adjusted trial balance. Look at the

worksheet, and consider the additional comments that follow.

After all adjusted trial balance amounts

have been extended to the appropriate financial statement columns, the

income statement columns are subtotaled. If credits exceed debits, the company has more revenues than expenses (e.g., $32,800 vs. $30,200 = $2,600 net income)). Or, an excess of debits over credits would represent a net loss.

To complete the worksheet, the amount of net income or loss is entered

in the lower portion of the income statement columns in a manner which

causes total debits to equal total credits. England Tours had a $2,600

net income, and a debit is needed to balance the income statement pair.

An offsetting credit is entered in the lower portion of the retained earnings columns. This credit represents income for the year that must be added to retained earnings to complete the preparation of a formal statement of retained earnings.

Within the retained earnings columns, the subtotal indicates that

ending retained earnings is $1,600 (noted by the excess of credits

($2,600) over debits ($1,000)); this amount is debited in the retained

earnings columns and credited in the balance sheet columns, thereby

bringing both sets of columns into balance.

No comments:

Post a Comment